Selling Made Simple – Myron Golden

Oldie but a Goodie 🙂 This information is timeless and big reason for Ultimate Leverage Success in business. Learn the power of leverage and remove yourself from the rat race.

Why Business Credit Cards Require a Credit Check

Getting a business credit card is typically easier than getting a small business loan or line of credit. But even business credit cards issuers tend to want to run a credit check when you apply.

For most business owners, getting a business credit card without a credit check is unlikely to happen. But if your business is well established and you have solid financials, there are some options available.

What Is Alternative Business Financing?

Alternative business financing is capital that you can borrow from non-traditional sources. This type of financing typically offers more flexibility in terms of the qualification criteria your company will need to satisfy, such as:

Credit Requirements

Collateral Requirements

Time in Business

As a tradeoff for the easier qualification requirements, alternative lending options generally charge higher interest rates and fees than bank loans. Alternative loans may require you to pay them back at a much faster rate as well.

However, if you can’t qualify for traditional business financing, an alternative business lender may be able to help you access the capital you need now. Plus, if you manage your alternative loan or line of credit well (and it reports to a business credit bureau), it might even help you to build business credit so that you’re in a better place to qualify for other types of financing in the future.

Read below for some highlights of three alternative lending options to help you build your business credit.

1. Online Business Loans

Once upon a time, if you wanted to borrow money for your business you had to make a trip down to your local bank branch or credit union to see if you could qualify for funding. However, a new generation of business lenders has since emerged to offer business owners an alternative way to secure capital.

Online lenders often have looser qualification requirements when compared with traditional banks. Nonetheless, you’ll still probably need to have decent personal and business credit to get approved. You should also expect that personal guarantees and collateral are common requirements for online loans — just as they’re often needed to secure traditional bank loans.

How to Qualify

- On average, your business must have been established for at least two years (though some lenders accept applicants with less time in business)

- Good business and personal credit are typically needed, but they may be less important (and the requirements may be less strict) than with traditional bank loans

Pros and Cons

Online loans can be a great option if you want to establish business credit, need business funding fast, or you’re only looking to borrow a small amount of cash. New businesses, unique businesses, and businesses without well-established credit history may also be able to borrow with an online lender when a traditional bank might say no.

But online loans aren’t always the most affordable option. If your primary concern is securing the lowest rate possible for business financing, an online loan might not make you happy. Traditional banks often (though not always) offer lower rates on business financing.

Also, some online lenders aren’t very transparent with their rates and fees. If you’re having a hard time understanding how much an online loan will actually cost you, try using Nav’s free small business loan calculators to translate fees and loan costs into APR. You can compare available offers from there.

2. Invoice Financing

Is your business structured in a way so that it gets paid after delivering services or goods to customers? If so, invoice financing is an alternative lending option that might work for you.

Invoice financing, sometimes called accounts receivable financing, is a way for a business to borrow against the money it’s owed by its customers. Essentially, your invoices become collateral for the funds you borrow from a lender.

How to Qualify

- Usually only available for B2B businesses based in the United States

- Credit requirements are generally less strict, but past credit issues, like bankruptcy or major liens, can be a problem

- You may need to have accounting software that shows at least three months (or more) of data

Pros and Cons

Invoice financing can provide you fast access to capital (often within 1-3 business days). The application process is usually easy and requires minimal paperwork to complete.

On the down side, invoice financing can be quite expensive (with APRs ranging from around 14% to 68%). Payback terms are generally rapid as well. In most cases, you’ll be expected to make weekly payments to the lender until the loan is repaid in full.

Because of the high costs and quick payback requirements, invoice financing is best reserved only for emergencies.

3. Microloans

Microloans are issued through non-profit organizations aptly named microlenders. Although the maximum loan size is generally $50,000, the average microloan issued to a small business or startup is a much smaller $6,000.

How to Qualify

- Usually only available to businesses with five employees or less

- Credit requirements are generally less strict, but past credit problems can cause qualification problems

- You may be required to attend a business training class

Pros and Cons

Interest rates on microloans aren’t the cheapest form of business financing available. But, the 12%-18% average rate is still reasonable, especially when compared with other alternative lending options.

Microloans are also known for having heavy documentation requirements. Thankfully, you may be able to receive mentorship from the lender as you navigate your way through the application process.

Perhaps the biggest benefit of using micro loans is the fact that they can potentially help you to build your business credit (assuming the account is reported to a business credit agency). So, if you pay on time and manage a reported microloan properly, you may set the stage for your business to qualify for better funding options from a bank in the future..

Before You Apply for Financing

Before you apply for any type of business financing, it’s a good idea to ask yourself the following five questions:

- Will this financing help me to solve a problem or strengthen my business?

- Can my company afford the payments on the money I want to borrow?

- How likely is my business to qualify for the loan?

- Is this the best deal available for my current situation?

- Does the lender report positive payment information to the business credit bureaus?

There’s no doubt that business financing can potentially be a powerful tool to help your business grow and succeed. However, all business financing — alternative or otherwise — comes with a level of risk.

It’s always wise to do your homework in advance before you decide to borrow money for your business. If you don’t rush the process, you’ll be much happier in the long term. You might even enjoy the added bonus of establishing a positive business credit profile that can be a valuable asset in the future.

See this article and more at NAV.com

3 Common Errors on Business Credit Reports – And How to Fix Them

Imagine the following scenario. You apply for financing for your business, but you’re turned down. When you ask the lender why your application was denied, it’s because of negative information that showed up on your business credit report.

There’s just one problem – the negative information on your business’ credit report is a mistake.

Common Errors on Business Credit Reports

It can be discouraging when problems on your business credit report keep you from qualifying for business financing or services. But when the negative credit information which is holding you back shouldn’t be there in the first place, it can be infuriating.

Here’s a look at three common errors found on business credit reports. (Keep reading below and we’ll show you have to fix these errors if they happen to your business.)

1. Mixed Business Reports

It’s surprisingly common for a business credit report to list accounts that actually belong to another company. The reason this type of error happens frequently is because of the way the business credit bureaus add information to credit files.

When a creditor (aka data furnisher) reports information to a business credit bureau, the bureau has to match the account with the correct company and add it to that business’ credit report. To accomplish this match, the business credit bureaus will pair up the account to a company’s name and address – but neither has to be exact.

If another business has a similar name or address to yours, there’s a possibility that business’ account could accidentally end up on your company’s credit reports.

With your personal credit reports, by comparison, the consumer credit bureaus look for a three out of four match of the following: name, Social Security Number, date of birth, and address.

It’s easy to see how the less-thorough data matching policy the commercial credit bureaus use to add information to a business credit report can lead to mix ups. The system itself leaves a lot of room for error.

2. Years in Business

Another mistake which can commonly show up on a business credit report has to do with the number of years your company has been in business. Here’s an example of a business credit reporting mistake which many business owners might be tempted to ignore. However, when it comes to your business, age matters (the older, the better).

On the surface, it might not seem like a big deal if your business credit report says you’ve been in business for only five years when it’s really been eight. Yet the age of your business is an important factor to many lenders when you apply for financing or vendor accounts for your company.

Note: The age of your accounts is an important factor in some business credit scoring models. If an account on your company’s credit report, like a business credit card, is reported as younger than it should be, the mistake might impact your credit scores unfairly.

3. Identity Theft

It’s no secret that credit reports contain a lot of personal, sensitive information that you wouldn’t want to get into the hands of the wrong people. On the consumer side, the Fair Credit Reporting Act prevents the credit bureaus from sharing your credit information with anyone who doesn’t have “permissible purpose” to access your data. Sadly, businesses don’t enjoy these same protections.

You have no legal right to privacy when it comes to business credit reports. The credit bureaus can sell them to anyone willing to pay for them.

In addition to the fact that your business credit reports aren’t private, information about your business may also be publicly available via your Secretary of State’s website. The bottom line is this – it’s not difficult for a fraudster to get his hands on your company’s information.

Once a thief has your business’ personal information (e.g. EIN, business name, and address), he may use it to open accounts in the name of your business. Business credit cards, lines of credit, business loans, and other sources of financing could be fraudulently opened in your business’ name, without your knowledge.

This potential for business identity theft is one more important reason why it’s crucial to monitor your business credit reports frequently. Monitoring your credit reports might not prevent business identity theft from happening, but it can enable you to react quickly if the crime ever happens to your company.

Fixing Errors

Unfortunately, errors on business credit reports occur more often than you might believe. A Wall Street Journal survey found that 25 percent of small business owners who checked their business credit reports discovered errors. Worse yet, the errors those business owners discovered put their business into a riskier credit category.

Your business doesn’t enjoy the same protections when it comes to credit reporting as you can count on for your personal credit reports. The Fair Credit Reporting Act, a federal law which protects consumers from inaccurate and unfair credit reporting practices, doesn’t apply to your business.

That being said, the business credit bureaus do allow you to dispute incorrect information on your business credit report when you discover a problem.

Here are five steps to fixing errors on your business credit reports:

- Check your business credit reports and review them for accuracy. It’s a good idea to check your credit reports with all three of the major business credit reporting agencies – Dun & Bradstreet, Experian, and Equifax.

- Make a list of any incorrect information you find, even if you don’t think the error is a big deal. Unless you’re a data scientist who creates credit scoring models for a living, you won’t really know whether a mistake has the ability to influence your business credit scores. It’s better to be safe than sorry and dispute any information which is inaccurate.

- Initiate a separate dispute with each business credit bureau that is including incorrect data on your business credit reports. Here’s how to submit a dispute with each of the three major business credit reporting agencies:

- Don’t take no for an answer. If your first dispute fails, but you know that the information on your business credit is wrong, it’s okay to follow up. Be sure to include supporting documents to strengthen your claim, if possible.

- Keep an eye on your business credit reports to make sure they remain accurate. Monthly credit checks are a good idea, both for your personal and business credit reports. If you’re checking your reports every month, you will be able to react quickly if and when a problem occurs. A free account from Nav can make this process a lot easier (and a lot more affordable).

Additionally, if the errors on your business credit report are a result of identity theft, the business credit bureaus may be willing to include a fraud alert on your report. Fraud alerts let future lenders know they should take extra steps to verify that any credit applications in your company’s name are legitimate.

No One Cares More Than You

In a perfect world, you would be able to expect your business credit reports (and your personal credit reports for that matter) to contain only accurate information. Yet the truth is that credit reporting mistakes happen all too frequently.

It’s up to you to review your credit reports – both business and personal – to make sure they remain error-free. No one else can do this job for you. Furthermore, no one cares more about the health and accuracy of your credit reports than you.

How DUNS Number Changes Could Affect Your Business

Businesses of all sizes should know of a significant change in the way government grants and contracts will be handled. The General Services Administration (GSA) announced in an interview with Nextgov.com that they are changing vendors for their federal contractor numbering system – better known as the DUNS (Data Universal Numbering System.) The system update won’t likely look different for companies right away, but here’s what you should know moving forward.

What is the DUNS?

The Data Universal Numbering System is a long-held practice for assigning businesses or organizations a unique identifier that can be used when applying for grants or contract opportunities through the government. The GSA runs contracting programs is the agency responsible for making sure businesses follow correct procedures when looking to be awarded government business – including ensuring their application includes a valid DUNS.

Since 1962, Dun & Bradstreet has managed much of the system, including the DUNS program – an addition to the system brought about by regulation in 1998. For twenty years, D&B has held the contract for managing validation and records. That all changed last year when the GSA announced they were opening up the role to competing bids.

| Nav is the ONLY source for businesses to see the #1 business credit score used by the SBA—the FICO SBSS Score. Get your FICO SBSS score with a Nav account. |

Who is the New Face of DUNS?

Ernst & Young won the contract, ending a two-decade involvement in the GSA by Dun & Bradstreet. Not only will the behind-the-scenes change significantly, but businesses could hopefully see some improvements, as well. The GSA is taking the opportunity to revamp what we know as the DUNS, replacing it with something they call the System for Award Management Managed Identifier, or SAMMI — for those of us who really like simplified acronyms.

What Can Businesses Expect?

There’s going to be a lengthy transition period, so – for now – not much will look different. The Ernst & Young transition includes a one-year “base period,” before four back-to-back, one-year options are potentially exercised. If the GSA keeps Ernst & Young on for the full five years, it would be, according to Nextgov.com a $41.8 million contract for the corporation.

The new partnership aims to make it easier to merge and secure data, simplifying how businesses compete for and renew government contracts and grants. While it’s too soon to tell just how the plan will work once it’s rolled out, anything that makes it easier for small businesses to earn and grow should be considered a welcome change.

How the Changes May Affect Vendors and Marketers

Under the old system, some government officials revealed concern that D&B had too much control over the use and licensing of the DUNS number, often charging third parties to access data on grants and contracts. While the GSA stated that Ernst & Young will also have proprietary ownership right to some of the data that was stored under the DUNS system, there’s no word yet on how data rights and the cost to access information will be handled. Getting a SAMMI number (similar to getting a DUNS) will be free to businesses and organizations registering with the new GSA system.

Reps for Dun & Bradstreet have emphasized that they seek to assist during the transition, as is indicated by the terms of their current contract.

My Secret Notebook From The Puerto Rico Mastermind

Want to see Russell’s top take-aways from the recent mastermind that he was at, with some of the top thought leaders in the world?

On today’s episode Russell talks about some of the things he learned during his recent trip to Puerto Rico for Brendon Burchard’s mastermind group. Here are some of the amazing things you should listen for in this episode:

On today’s episode Russell talks about some of the things he learned during his recent trip to Puerto Rico for Brendon Burchard’s mastermind group. Here are some of the amazing things you should listen for in this episode:

- Why Russell almost didn’t go to the mastermind group, and how Collette convinced him that they should go.

- What some of the gold nuggets were that Russell picked up from people like, David Bach, Ethan Willis, and Rachel Hollis.

- And what mastermind group Russell recommends for you to be a part of for you to get the most success with your business.

So listen here to find out what kind of awesome tidbits Russell picked up at the Puerto Rico Mastermind.

—Transcript—

What’s up everybody? This is Russell Brunson, welcome back to the Marketing Secrets podcast. This episode I want to bring you behind the scenes of some of the cool takeaways, nuggets and ideas I got at the most recent Puerto Rico Mastermind with Brendon Burchard and a whole bunch of other amazing people.

Hey everyone, I hope you guys are doing awesome. I know I’ve been telling you guys for the last couple of episodes that I was going to tell you about this amazing trip we had to Puerto Rico and kind of pull you into some of the cool details behind the scenes of what happened. I wish I had everything recorded and I could just sell you guys access to the videos, because that would be amazing for me and for you and for everybody. But unfortunately there were no video cameras allowed. So all I had was my notebook and my thoughts, so that’s what you’re going to get today. I hope you guys are okay with that.

Kind of the preface of what this event was, so if you’ve been listening to the podcast for a while I did this episode last summer, or last, I don’t even know when it was, it was probably 8 or 9 months ago about this secret illuminati mastermind meet up meeting that I had in Wyoming. We flew out and we took helicopters and all these amazing business owners were there. And it was run by Brendon Burchard and there was a whole bunch of, the list of people that were there was awesome.

So I had a good time, learned a bunch of really cool things. And it was kind of almost more like a, I don’t know, I’m used to marketing meetings. I’m a hardcore marketing dude who just wants to know marketing and that’s all I care about. And then I’m around all these personal development people and they are all talking about other things and it turned into this event where we’re crying and changing our emotions and all sorts of crazy stuff that I’m not used to. But I really enjoyed it and had a great time.

Anyway, now fast forward 8 months later and they were going to do a second meeting. And I wanted to go and then they were going to bring our spouses and stuff, which I thought would be really cool. But then literally the day the event starts is the same day we were getting home from our Disney Cruise with our kids and I’d already been away for like 10 days. And I was just like, I can’t do it. So I basically told Brendon, “Hey, we can’t go.”

Then fast forward to Funnel Hacking Live, I don’t think Brendon got my email or my text or however I told him because he didn’t know about it. So backstage, I can’t remember if it was before or after his presentation, he’s like, “Dude, you’re coming to Puerto Rico right?” I’m like, “No.” and he’s like, “What? You’re not coming? It’s going to be amazing.” And starts naming off all the people and my beautiful wife, Collette was next me and one of the people that was at last year’s meeting was Dave Hollis and his wife is Rachel Hollis.

And if you’ve read, or your spouse, I guess your wife or spouse or whatever has read Girl, Wash Your Face or Girl, Stop Apologizing, that’s written by Rachel Hollis. It was the number two bestselling book all of last year. The only person that beat her was Michelle Obama, so I think she cheated, but who knows.

Anyway, the book’s awesome. I read it first, I had Collette read it, I had tons of people in my office read it. Men and women. And it’s an amazing book. And she’s blown up and just doing a bunch of stuff. Collette loves her, we listen to her podcast, we listen, her podcast is called the Rise podcast and her and Dave have a podcast together called Rise Together, which is a really great couples podcast. It’s just awesome.

So over the last 7 or 8 months since the last event, we’ve really, not directly connected with them, but through their content and through what they do, I’ve had just an amazing time with that. So Dave said, or Brendon said, you know, he’s naming all the people, he said Dave. And Collette’s like, “Well, is Rachel coming.” And Brendon’s like, “Yeah, Rachel’s going to be there too.” And Collette looks at me, she’s like, “We’re going.” I’m like, “Oh great. How am I going to fit this into our busy schedules?”

But we decided to go and I’m super grateful we did. We’re lucky, Brent and Amber Coppieters went on the Disney Cruise with us, their kids and our kids, and then we got back from the cruise, we just pulled into Miami or whatever and they jumped into a plane with our kids and flew them and their kids, like 9 kids, my kids and their kids, flew them home. And then Collette and I jumped into a plane and flew to Puerto Rico.

And we got there a day early so we had a chance to go to the spa there, which was insane. So many cool stories. And then the next day the masterminding happened. We had a chance to hang out with everybody, get to know them all, just had a really good time.

Anyway, I’m just going to kind of go through my notes here and pull out some of the cool things I got that I think you guys will benefit from. I may remember some of the people, some of these thoughts may be just completely disjointed, but I’m going to share them anyway. If you listen to my podcast, I’ll do whatever I want. And hopefully everyone will get some value, some gold out of one of the nuggets that I’m dropping behind.

Alright, so with that said, I’m going to jump into my notes. So the one thing that Brendon had us do at the very beginning of the mastermind which is fascinating, he talked about a lot of times we set goals or to do’s of things we want to accomplish and he said, “Instead of thinking of things as to-do’s we need to start thinking of things like scenes.” He said, if you take a timeline and go backwards in time, what are the scenes that are most memorable of your life.

So I started thinking, I remember when I won my state title as a junior in high school. That was just a scene in my life that I dreamt about, it was amazing, it happened and I can always go back. That was an amazing thing. My senior year, when I took second place high school nationals, I became an all American. That is a scene in my life. When I served a mission for my church, some experiences there are different scenes. And when I met my wife and I proposed to her and we got married and then when the twins were born, when we got pregnant with the twins after not being able to get pregnant for months and months.

All these things are scenes in your life, right. When you look at a scene that’s like colorful and beautiful and you can feel it, you can experience it, it’s an emotional thing. So he said, make a timeline and in the back right all the scenes you remember in your life that were impactful that shifted your destiny. So I’m kind of writing those out.

And then he said, “What I want to do for now, is write all these different, in the timeline, have all these ticks in the timeline. And then instead of having a goal, I want you to project a scene in the future.” And he said, for example instead of “I’m going to make a hundred million dollars this year.” It’s like, “When we hit our goals we’re going to go on this amazing…’ Project the scene and make it colorful and beautiful. And some of you are visualizing, and try to visualize and imagine the experiences and the celebrations you have with that thing.

And what happens when you don’t just have a goal and you create these scenes in your mind of what it’s going to be like when you accomplish the goal, or the journey of the goal, whatever it means, then that thing draws a meaning to the goal. Instead of just being a goal, like why do you want to have a goal of getting into the Two Comma Club, I don’t know. The reason why someone in my world would want to get into the Two Comma Club is they were at Funnel Hacking Live, they saw people on stage and they visualized that next year they were going to be onstage getting that award. Holding it up and getting the picture taken with me, that kind of thing.

They were projecting a scene of their goal, and that scene in their mind draws meaning to the goal, which is the thing that actually draws you to it. And the better you can describe this scene the better, the more real it becomes. So describing it to yourself or your spouse or on your podcast or whatever. But the power of that is really, really cool.

But what he had us do was make a timeline and back in time what are the scenes that happened, and then what were the meanings that I drew from those scenes? Then moving forward, what are the scenes that I want to experience? And then trying to visually experience those and see those, which was really, really cool. So that was something cool I learned from Brendon.

Let’s see, I can’t remember who this one, oh, this was Craig Clemons who was one of the greatest, probably one of the greatest living copywriters right now. He’s amazing and he was talking about the different products in his product line. He’s got this huge media company that’s killing it, doing crazy numbers.

And he said, “If you look at all the..” he published different doctors and their products and books and supplements and things like that and he says, “My goal in marketing is to rewrite the story that’s inside of people’s heads, right.” So the reason why people are struggling in any area of life, is there’s this story in their head. He says, “My job, through my copy and videos and product and everything is to rewrite the story in their head.” And as he said that I just wrote, I wrote down, “Rewrite the story.” And then I wrote next to it with a big starburst around it, “New opportunity” if you read the Expert Secrets book we talked about new opportunities.

It’s all about that, right. If I had to get somebody to shift from the vehicle that they’re in right now to get them into the vehicle that I know is going to get them to their future, I’d figure out what are the false beliefs they have? What’s that story in their head? And then my job is, as a marketer and a story teller, is to rewrite that story. And you do that by writing a better story, crafting a story that they will then believe. And when you do that, then they will follow you. And I just thought it was kind of cool that he looked at what he does as a copywriter, he’s rewriting stories in people’s heads. I was like, “Yes, I get that. That’s what I do too. It’s so exciting.”

Okay, alright I’m going to keep going through these notes here. Oh, one thing. So Tom and Lisa Billaboo, they are the founders initially of Quest Nutrition, which is Quest bars, which is one of my favorite companies out there. They ended up getting it valued at a billion dollars and then they sold their stuff, and then they started this thing called impact theory, which is an amazing podcast, youtube channel and a bunch of stuff.

But it was funny because we were going on this hike, and everyone was doing it because we were supposed to, but no one really wanted to. We wanted to go back and we wanted to do mastermind and stuff, but we felt obligated to do it. And everyone was kind of sitting here, we were at the halfway point of like, “Do we keep going on or do we stop?” We were having some car issues and some people were getting sick, so we kind of pulled over.

And he said something that was really powerful. He said, “I always ask my wife this. I say, “what are your selfish desires? Just tell me what are your selfish…do you want to do this? Do you not?’ and she says ‘My selfish desires I’d rather do blah blah blah.” He’s like, “Cool, I’d rather do that too.” And it was pretty cool.

So he asked us all, “What’s your selfish desire? If you’re being selfish what’s your desire, what do you really want?” And then we all told it. So it was like, oh, we all wanted the same thing. So then we just did it. When most of the time we don’t tell people our selfish desires because we sound selfish and we hold it back and we don’t just use that as a tool. And because of that half the time we end up going on these long rants or long problems that become bigger and bigger and bigger because we don’t just communicate what we really, really want.

And he said that’s a tool they use all the time when they’re both trying to decide something like, “I don’t know what to do. What do you want to do?” That kind of indecision, he stops and says, “What’s your selfish desire. If you could do anything, selfishly, what would it be.” And then boom, that’s how they are able to go and figure out that’s what they’re going to do. But it was just kind of a cool tool for me that I thought was awesome.

Okay, gall I could spend days going through all this. I’m trying to find some of the really, really important things that I think will have the biggest impact for you guys here. Sorry, I just gotta make sure. Okay, one of them David Bach was there. If you know David Bach, he’s written like a billion books. They’re all like New York Times bestsellers like a million times over. And he’s got a new book coming out called the Latte Factor and I think it’s his first new book in a while. And he was asking questions on how to launch a book.

And low and behold Mrs. Rachel Hollis jumped up, whose sold more books than anyone on planet earth last year and she’s like, “This is what I did.” And I’m like, ‘Oh” freakishly writing notes as fast as I could. And it was interesting, she started going through this. It made me so happy.

Some of you guys know I’m writing the Traffic Secrets book right now, and in chapter two it’s called Dream 100. And she never said the word Dream 100, but what she explained was the Dream 100 concept to a T. She said, “What are the tribe that my women are already in? And we do tribe infiltration.” So she said, ‘What network marketing companies are they in? What Facebook groups? What Instagram channels? All these kind of things. What hashtags are they following.” And they find those people and say, “Who are the tribe owners that I’ve got to infiltrate? Who do I need to become friends with?”

So she said, they basically went to instagram and anyone that had over 200,000 followers they would just DM them and be like, ‘Hey this is so and so, can we talk.” And it just started going crazy messaging anyone that had over 200,000 followers to build up their dream 100, their list of influencers, they’re tribe, the tribe leaders. Then they’re whole job is tribe infiltration. Anyway, I thought was so awesome. They pre-sold 200,000 copies of her new book, Girl, Stop Apologizing, before it went live, which is crazy.

And then Lewis Howells jumped in and talked about how he sold his book. What he did is he went and found the 20 biggest podcasts, not the little ones, but big podcasts that moved the needle in book sales, and went and did in depth, really amazing interviews with those people on the books to get his book to become a New York Times Bestseller. So it wasn’t like, ‘I need 500 podcast interviews.” But what are the 20 most strategic, best podcasts I could be on that are going to drive a ton of book sales, which would be awesome.

Alright, that was some cool stuff. So many good things here. Ethan Willis who is one of the partners at Growth.com, he talked about purpose management which was really, really cool. I’m not going to go too deep into that because, it was just like, “What’s process management? What’s your purpose management? What is your purpose? What’s the reason why you’re doing this thing and that thing?” really going deep and remembering your purpose. He said, “If I were to die in 3 years what would I have to do to get…right now it’s like, based on that, what should you do right now? Go and do those things.” So good, so many, I wish, he went on this 20 minute rift that was just, I wish I could record, that would have been amazing for everyone.

A lot of these are just ideas I wrote down of like cool things we could do as we’re launching books and things like that. Yeah, I think I might be done with the stuff I’m going to share. Looking if there’s anything else really big that pops out. Okay, one thing. I hope she doesn’t mind that I’m sharing this. But Rachel Hollis’ big question was like, “Okay, we had all these goals and all these dreams and then we hit them all. Now what? Do we try to make more money? Do we just, are we okay with that? What’s okay?” I think that’s a question a lot of people, especially religious people, that we ask, “Is it okay that I’m doing this? Is it okay that I’m making more money? Should I be content? Should I….” You know what I mean?

And a couple of things were really good that were said to her. One is that when you start looking at these things that are happening to you, the phrase I wrote down says, “It is not mine, I am a steward.” So I look at that like, this business, this money, it’s not mine, it’s God’s and I’m a steward of it. So if you look at it from that way, it’s like I’m a steward of it. I’ve been called to do these things, then you start looking at it differently. If I’m a steward of this money, or this platform, or this role, what does he want me to do? Does he want me to shut it down and shrink? No, that’s not what he would want. He would want you to magnify it right, bring your calling out and do the best you can and stuff like that.

And then the second thing is like, am I going to run out of ideas? What’s going to happen? And it’s like, if you are the steward then, and it’s coming from God and if you are the steward, then he’s going to keep giving you light and knowledge because you’re the steward of this thing that you’re doing and you’re doing the right things, you’re moving forward.

A couple of other phrases I wrote down, “It’s because of you, it’s through you.” So it wasn’t you that did, it’s not because I’m great that this thing happened through me. And I see that all the time in our community. So many good things. Mother Theresa said, “I am the pencil.” I’m not the one doing the work, I’m the instrument that’s writing the thing.

Anyway, I think that’s the core part of the notes I was going to share. But I hope that gives you guys a couple of nuggets from my mastermind group. And if you’re not part of a mastermind, go and be part of one, plug into one. You should definitely join the Two Comma Club X one because that’s the best one. Or my inner circle, because that’s the next level which is even better. But as of right now, you can only sign up at Funnel Hacking Live. I think eventually we’re going to open them up to the mass public, but for right now it’s closed down.

So do what you can to get into a new mastermind group. And I’d recommend getting the Two Comma Club X mastermind group, it’s an amazing program. In fact, we have our first event of the year with those guys coming up next week, which is exciting.

Anyway, I’m going to go. I’ve got so many more things I want to share with you but the night is young. Actually, the night is not young, the night is late and I gotta go. So appreciate you guys all, thanks so much for everything and I will talk to you on the next episode.

How To have Good Credit After A Divorce

HOW TO REPAIR YOUR CREDIT AFTER DIVORCE. Did your credit get hosed by your ex-lover? Have you gone through a divorce or are you starting over?

Here is what to do and what not to do with your credit after divorce so you can continue to move forward with you life. No more train wrecks!

Here are several practical tips that have helped us, that you can implement to see a major shift in your business.

At Wholesale Tradelines, they legally add positive history to your credit report with seasoned authorized user tradelines. They do this by adding you as an authorized user to an existing credit card account that has a long history of perfect payments, with little or no balance. This can recalculate your credit score with drastic results.

What Is Bad Credit and What Are Its Effects?

What Is a Bad Credit Score?

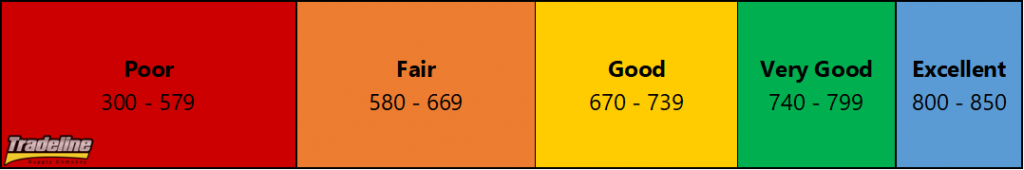

The definition of “bad credit” varies depending on which credit scoring system you are talking about. Since FICO 8 is the scoring model most widely used by lenders, we will focus on FICO when discussing the question of what is considered bad credit.

The FICO 8 credit scoring system assigns consumers a number to represent their creditworthiness, with the lowest credit score possible being 300 and the high end of the scale being 850.

A high credit score shows that lenders can be fairly confident that someone will repay debts because they have demonstrated responsible behavior when it comes to credit in the past.

A low credit score, on the other hand, means that someone represents a higher risk to lenders because they are thought to have a higher probability of defaulting on a loan.

According to Credit Karma, a FICO score between 300 to 579 is considered a poor credit score, while a fair credit score is between 580 and 669. In contrast, an excellent credit score is between 800 and 850.

Credit scores between 300 and 579 are considered poor credit.

What Gives You Bad Credit?

As we mentioned, a bad credit score means lenders perceive you as a high-risk borrower. Therefore, what causes bad credit is poor management of credit and risky behaviors that indicate you may have a higher probability of default.

For example, being late on payments or missing payments altogether can really hurt your credit because payment history is the most important factor of a credit score.

High credit card utilization can lead to bad credit. Photo by Natloans

What causes bad credit specifically? Here are some examples:

- Late or missed payments

- Defaulting on a loan

- Charge-offs

- Collections

- Judgments

- Settlements

- Bankruptcy

- Foreclosures or repossessions

- Maxed out or high-utilization credit cards

- Too many inquiries at one time

- Too much new credit

Sometimes people have bad credit because of things they can’t control, like having a medical emergency that leads to huge hospital bills that they can’t afford to pay. In fact, the majority of consumer debt in collections is medical debt, according to Magnify Money.

Bad Credit Loans

If you have bad credit, you’re likely going to have a hard time getting loans with favorable terms or getting approved for a loan at all. Since a bad credit score represents a high risk for the lender, loans for people with poor credit typically have higher interest rates and may require collateral or a down payment—if the lender is willing to approve the loan at all.

Personal Loans for Bad Credit

Payday loans can come with interest rates of up to 400%. Photo by Aliman Senai.

Personal loans for bad credit are few and far between. Usually, at least fair credit is needed to be considered for a loan. Bad credit loan lenders may charge very high interest rates since they are taking on a lot of risk by lending money to someone with poor credit. These higher interest rates may translate into thousands of dollars of additional interest payments over the term of a loan.

Very bad credit loans such as payday loans often have astronomical interest rates of up to 400%, which makes it nearly impossible for many consumers to get out of debt.

Bad Credit Car Loans

Bad credit auto loans, also known as subprime auto loans, are often considered “second-chance” loans because they are typically the next option for those who have been rejected for traditional auto loans. Although there is not necessarily an official dividing line between which credit scores are considered prime and subprime when it comes to auto loans, credit scores below 620 tend to be considered subprime.

Bad credit car loans can have triple or more the interest rate as prime auto loans. Photo by QuoteInspector.com.

Car loans for bad credit, similar to personal loans for bad credit, are associated with much higher costs than prime auto loans. Since lenders of second-chance auto loans are taking on additional risk, these loans often have significantly higher interest rates and more fees than auto loans for consumers with good credit. Additionally, car loans for bad credit may come with penalties for paying off the loan early.

According to Investopedia, “While there is no official subprime auto loan rate, it is generally at least triple the prime loan rate, and can even be five times higher.”

Credit Cards for Bad Credit

If you have bad credit, your options for getting a credit card will be limited, and you will most likely not be able to get the perks associated with premium credit cards, like low interest rates, high credit limits, and rewards. Credit cards for poor credit may also have annual or even monthly fees.

Subprime credit cards often require you to make a deposit with the lender as collateral. These cards are known as secured credit cards since they are secured by your deposit, which the lender can keep if you fail to make payments on the card. Sometimes, the lender may be willing to switch you to an unsecured card after a period of on-time payments.

As we’ve seen with loans for bad credit, credit cards for bad credit, both secured and unsecured, will likely have high interest rates, sometimes as high as 30% or more.

How to Fix Bad Credit

Having bad credit is expensive. It makes getting any kind of credit more difficult and more costly, because bad credit lenders tack on high interest rates and fees to compensate for the higher financial risk of poor credit loans.

Bad credit doesn’t just dramatically increase the cost of credit. It can also affect other aspects of your life, such as your insurance premiums, your ability to find housing, and even your job, since many employers now check prospective employees’ credit scores. Therefore, most people with bad credit want to fix it as soon as possible.

Improving bad credit takes time and patience. While credit repair companies may claim to have tactics that can boost your credit fast, the reality is that these tactics are usually limited to removing inaccurate information from your credit report. If you remove everything from your credit report, what are you left with?

Rebuilding credit with positive credit history helps to fix bad credit.

The best way to fix bad credit is to rebuild it with positive credit history over time. In other words, you need to add more positive accounts to your credit profile and keep them in good standing while they age. At certain age levels, these accounts should begin to boost your credit profile with all that positive payment history.

Generally, though, building credit through opening new accounts can take at least two years to see much of a positive effect. The best way we have seen to bypass this period is by piggybacking on the good credit of others.

Otherwise, repairing bad credit requires demonstrating that you can use credit responsibly by building up a positive credit history over time.

How To Scale Your Business

Want to scale your business fast? It does not matter what type of business it is, the formula for scaling is the same. Here are several practical tips that have helped us, that you can implement to see a major shift in your business.

Wholesale Tradelines legally adds positive history to your credit report with seasoned authorized user tradelines by adding you as an authorized user to an existing credit card account that has a long history of perfect payments, with little or no balance. This can recalculate your credit score with drastic results.

Wholesale Tradelines also have a proprietary, fast and effective credit sweep and inquiry removal service. Additionally, we give those with good credit, the opportunity to earn a monthly passive income in our cardholder program.

904-515-6698 (call or text)

val@wholesaletradelines.com www.wholesaletradelines.com

Let them know you heard about them from ultimate Leverage.

Are low credit scores impacting your life negatively?

Are you frustrated with low credit scores? | Are low credit scores impacting your life negatively? These 3 simple tips can help…

At Wholesale Tradelines, they legally add positive history to your credit report with seasoned authorized user tradelines. They do this by adding you as an authorized user to an existing credit card account that has a long history of perfect payments, with little or no balance. This can recalculate your credit score with drastic results.

Wholesale Tradelines also has a proprietary, fast and effective credit sweep and inquiry removal service.